VISION AND STRATEGY

The vision of PSC HK Group is the premier brand and to continue to dominate its market leader position as one of the largest independent local insurance intermediaries in the Hong Kong market. To achieve this, PSC HK Group is devoted to delivering professional, high quality and value-added service to customers with timely, responsive, and appropriate solutions.

Moving towards this direction, PSC HK Group has adopted to develop a mutually beneficial and long-term relationship with its business partners – customers, agents, brokers, and insurance principals.

PSC HK Group’s mission is to outperform other market players; it is working towards this target by excelling in the critical success factors – efficiency, flexibility, loyalty, professionalism, and teamwork.

MARKET POSITION

In a market-driven environment, PSC HK Group has strengthened its position as a market leader in the local insurance industry. To further gain a foothold in this industry, PSC HK Group not only adapts itself to the dynamic environment forces but also identifies and leverages its resources and competencies which yield new opportunities and provide a competitive advantage.

PSC HK Group has a very solid customer base consisting of small and medium-sized enterprises in diversified industries. The resources of PSC HK Group will also align with the development trend of Hong Kong which focuses on financial sectors, logistics, tourism, SMEs, technology, creative industries, etc.

With the full support from its loyal customers and ‘long-term relationship’ partners, PSC HK Group rests assured of being the premier brand in the insurance market.

COMPANY STRUCTURE

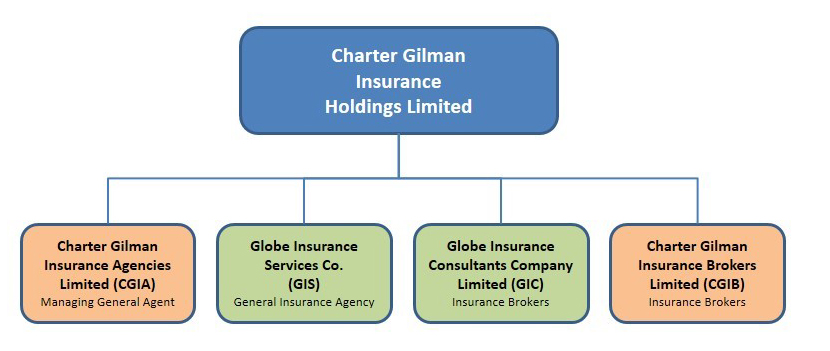

PSC Insurance Holdings (HK) Limited (“PSC HK”), formerly known as Charter Gilman Insurance Holdings Limited (“CGIH”), is the holding company of the Group in Hong Kong. The operating business units of the Group are illustrated in the chart below.

CGIA represents a number of reputable Local and International Insurers in the region and still maintains its recognition of the original brand, whereas CGIB has free choices of insurers. Nowadays, CGIA represents a total of four reputable insurers mainly on a managing general agency or an underwriting agency basis.

| Insurers | Country of origin of the ultimate holding company | Represented by |

|---|---|---|

| MSIG Insurance (Hong Kong) Limited | Japan | CGIA |

| Falcon Insurance Company (Hong Kong) Limited | Canada | CGIA |

| AXA General Insurance Hong Kong Limited | France | CGIA |

| QBE Hongkong & Shanghai Insurance Limited | Australia | CGIA |

MANAGEMENT

Hei Wong, PhD, MBA, BCom, ANZIIF (Fellow)

Managing Director

Hei Wong has been working in the profession of insurance for over 35 years. He undertook his Ph.D. in Finance with Shanghai University of Finance and Economics after obtaining his MBA and Bachelor of Commerce majoring in Accounting and Finance. He is a Fellow member of The Australian and New Zealand Institute of Insurance and Finance (ANZIIF) examination. Hei started his insurance career in a general insurance company in 1981. In 1992, he joined a JV company of New World Insurance Group of Companies in Thailand and since then he had been responsible for various divisions of the group in Southeast Asia and the Greater China region.

Hei is the founder member and first President of the ANZIIF Hong Kong Branch and BrokersLink Asia Pacific. BrokersLink (www.brokerslink.com) is one of the leading global brokerage organizations employing over 10,000 professionals with coverage in more than 100 countries.

He is very committed to the community where he lives. He is the Chairman of Insurance and Risk Management Services of Guangdong-Hong Kong-Macao-Bay Area Economic and Trade Association. Hei has been awarded as an Honorary Life Fellow member of ANZIIF in recognition of his work and contribution to establishing the Hong Kong Branch and opening up the mainland China market for the Institute.

Feature Yip, BCom, ASII, ANZIIF (Snr Assoc), CIP

Senior Advisor

Feature has over 40 years of insurance experience in the underwriting and brokering industry with various international insurance, reinsurance, and broker companies in Hong Kong and Singapore. He is one of the founders of PSC insurance intermediary companies in Hong Kong and is a key member in helping to expand the brokerage business of PSC in Hong Kong.

Feature holds a Bachelor Degree in Commercial Science. He is an Associate Member of the Singapore Insurance Institute and a Senior Associate of the Australian and New Zealand Institute of Insurance and Finance.

Herman Cheung, ACII, Chartered Insurance Broker

General Manager

Herman joined the original Gilman Insurance Agencies business in 1987 but also has many years of working experience in one of Hong Kong’s major insurance companies, Carlingford Insurance Co. Ltd (a wholly-owned subsidiary of HSBC). He is responsible for underwriting and provides technical support for specialty classes. In addition, he has been a member of one of the Insurance Federations’ technical bodies and has been working as an Executive Committee Member of the Professional Insurance Brokers Association. He is also a holder of the Insurance Broker Qualifying Certificate of P.R.C.

Alan Cheung, BSc (Hon), ANZIIF (Snr Assoc)

Assistant General Manager

Alan has been working in the profession of insurance for more than 30 years. He has wide exposure and experience in the insurance field and has been holding managerial positions in major insurance companies and intermediaries for years in Hong Kong and the UK. Alan now has responsibilities for the overall operation of the CGI brokers division with involvement in strategic account servicing and business development. He graduated from the University of London with a Bachelor Degree in Economics and Management and is a senior associate member of The Australian and New Zealand Institute of Insurance and Finance.

Gilbert Shing, FLMI (Fellow), ACS (Associate)

Account Director and Compliance Officer

Gilbert started his insurance career with an international life assurance company over 30 years ago after his graduation from City Polytechnic of Hong Kong (now known as the City University of Hong Kong) with a professional diploma in Company Secretaryship and Administration under the Department of Accountancy. He joined a local insurance brokerage company in 1993 and was responsible for servicing a number of major corporate clients with needs of special lines of insurance including D&O, PI, products liability, and trade credit. Over the last fifteen years, Gilbert was responsible for structuring, developing, and maintaining a high-end medical insurance portfolio in Greater China region for London-based legal expenses and health insurance underwriter. He joined CGI Brokers in 2020 with the responsibility for the development of special lines of niche portfolio as well as compliance with regulatory issues. Gilbert is a Fellow member of the Life Management Institute (LOMA).

Soloman Ngan, MBA, FCII, LLM (China Law), ANZIIF (Senior Associate), FLMI

Special Project Director

As a Special Project Director of Charter Gilman Insurance Brokers Limited, Solomon is responsible for exploring potential business opportunities to improve business performance and achieve the strategic goals of the company. Solomon has embared on his insurance career since June 1989 after obtaining his bachelor’s degree in Canada in 1986. He has held various managerial positions in insurance brokerage, bancassurance and insurance companies with extensive experience in broking, underwriting and marketing.

Before joining Charter Gilman Insurance Brokers Limited, Solomon was the director of Aon Hong Kong Limited, Commercial and Retail Division and Managing Director of Beijing Nova Insurance Services Limited with nearly 2 decades of relevant experience in Greater China.

GLOBE INSURANCE CONSULTANTS COMPANY LIMITED (“GIC”)

GIC is a specialist insurance broker company and a pioneer in emerging risk, apart from providing a full range of traditional general insurance, employees’ benefits, industrial risks, trade credit, and contingency & entertainment insurance to many local SME clients.

GIC’s Patent & IP Insurance Team provides patent and intellectual property (including licensing agreement liability) insurance to a wide spectrum of business clients, like research and development, software, branding and design, life science, technology, creative industries, energy, manufacturing, automotive, packaging, design, and advertising companies. We also connect with other patent attorneys, intellectual property lawyers, and trademark agents. This team also liaises with the Intellectual Property Department of the Hong Kong Government, Hong Kong Trade Development Council, Licensing International, local universities, and other industry groups and associations for promoting awareness of intellectual property and licensing in the industrial and commercial sectors in Hong Kong.

In addition, we are also focusing on life science R&D, we provide insurance services for covering financial loss, patent defense, clinical trials, and products liability for companies involved in life science R&D, such as drug development, medical device development, clinical research, pre-clinical testing, contract manufacturers, and clinical trials.

From July 1, 2021 until June 30, 2022, Globe Insurance Consultants Company Limited (“GIC”) successfully transferred and merged all its general insurance business with Charter Gilman Insurance Brokers Limited. As of June 30, 2022, only long-term life insurance and MPF business are retained by GIC. Subsequently, GIC has been sold to an independent third party. As from July 1, 2022, GIC is no longer a PSC Group member company.